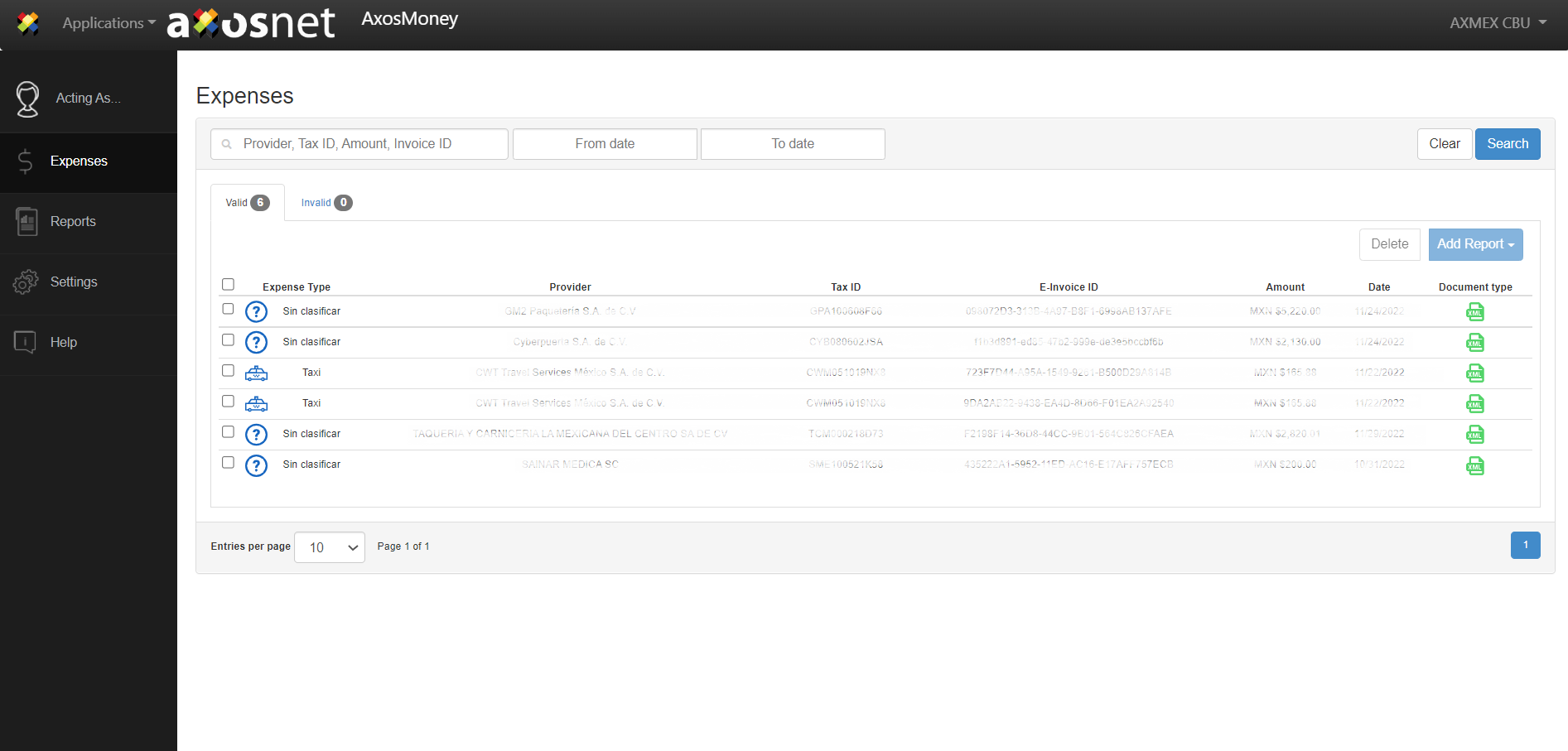

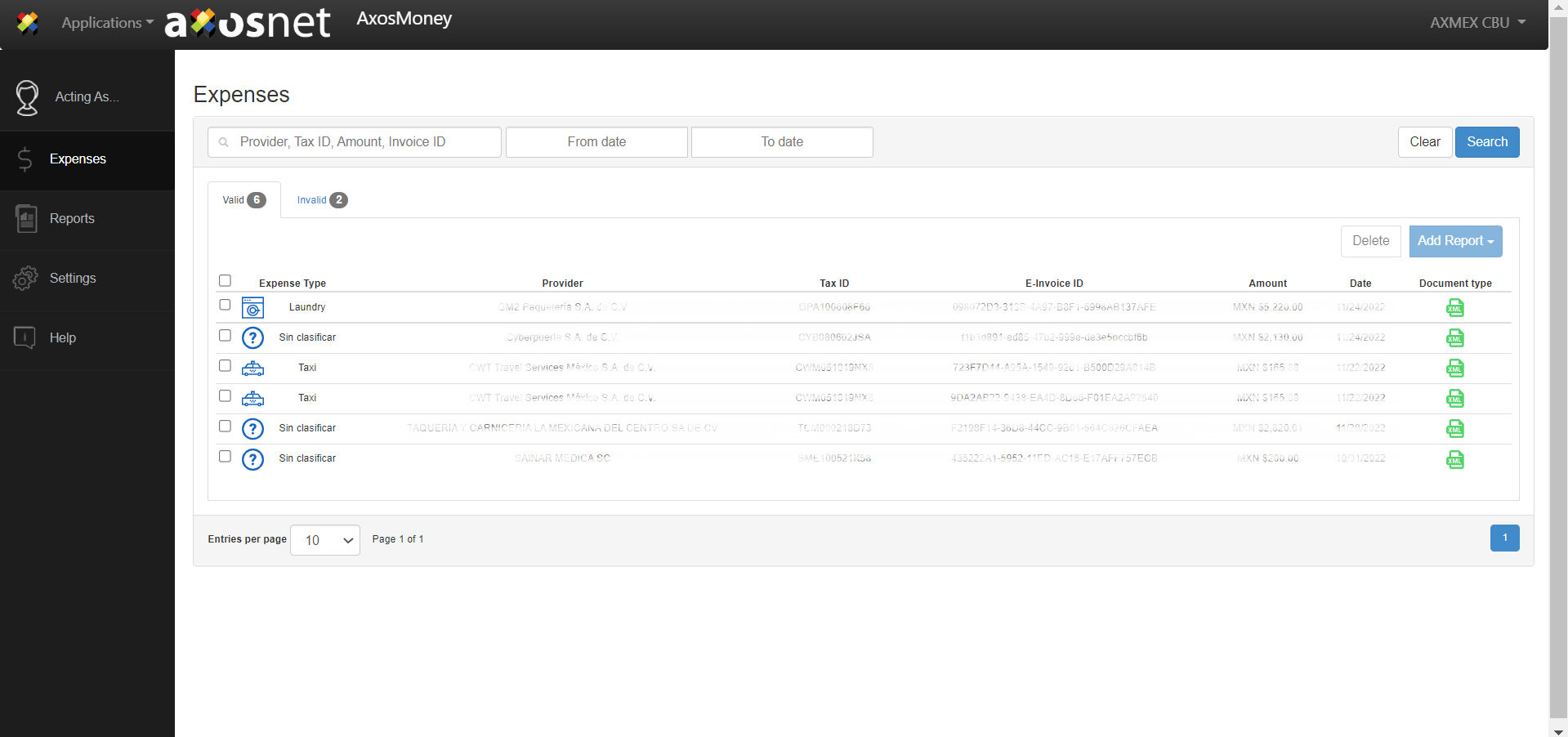

When a user enters the “Expenses” menu, the “Valid” expenses list is displayed by default. This section briefly describes the fields and functions that appear when an expense is valid. An expense is considered valid in AxosMoney if it meets the SAT’s validity criteria as well as the tailored parameters configured in AxosMoney by the administrator of AxosMoney in your company.

For future reference about the configuration of the validation parameters, please refer to Application Management \ AxosMoney Expense V3.0 in the ACS Manual.

Classify an expense

Once the expenses have been validated and based on the information within a CFDI document, AxosMoney proposes a type of expense. Still, the user can re-classify it afterward if he so wishes.

To classify or change the classification of an expense in AxosMoney Web, follow the steps that are written below:

1. Enter the option “Expenses” from the main menu. The icon “?” will appear when an expense is not classified.

2. Click the expense you want to classify.

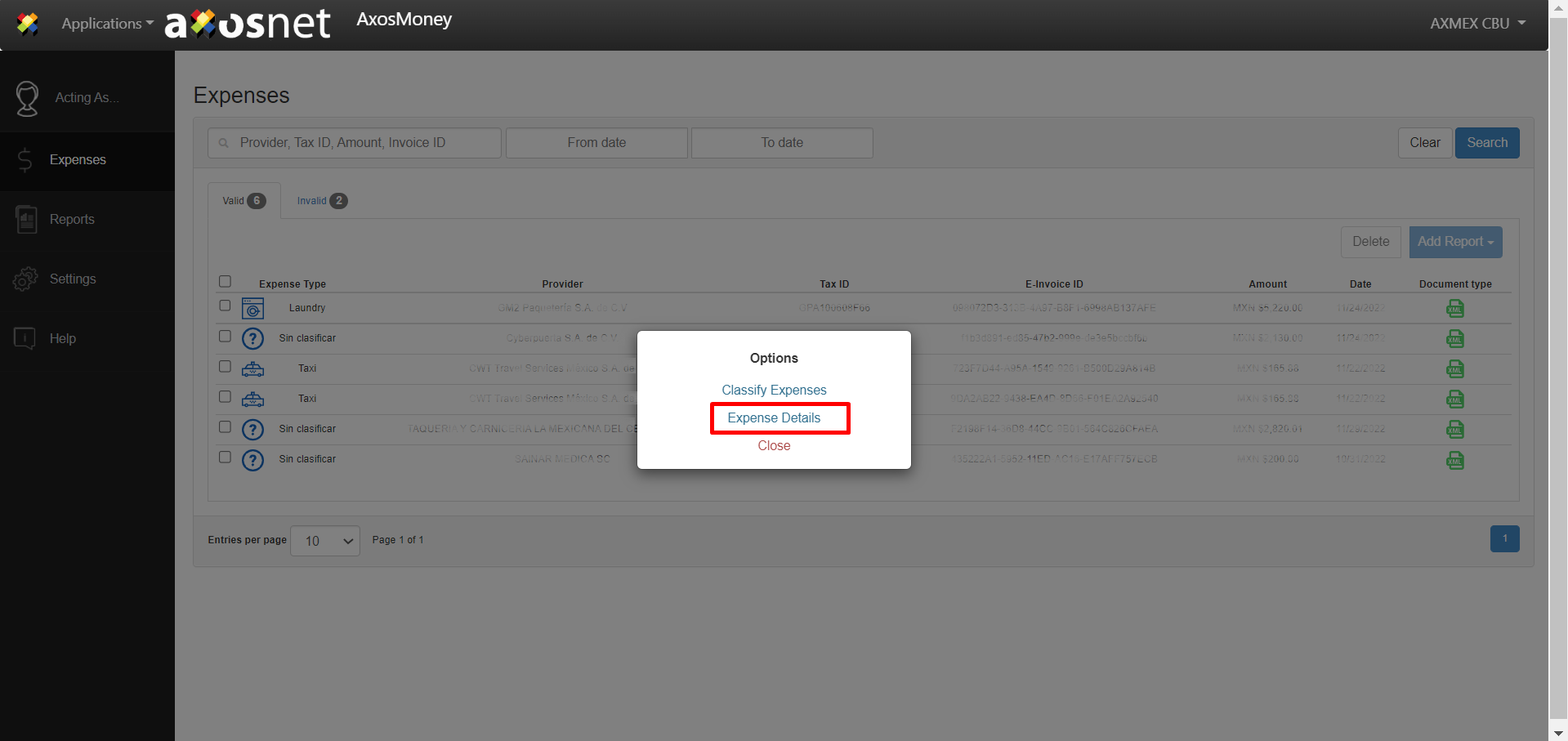

3. The system will show a window with 3 options. Below is described what each of them is:

- Classify Expense: Assign an Expense type to your expense in case the application did not detect it or if it is incorrect.

- View File: It shows on the page the result of the validation of the CFDi and optionally allows you to send it by email.

- Cancel: Close the window and return to the list of expenses

Select the option “Classify Expenses.”

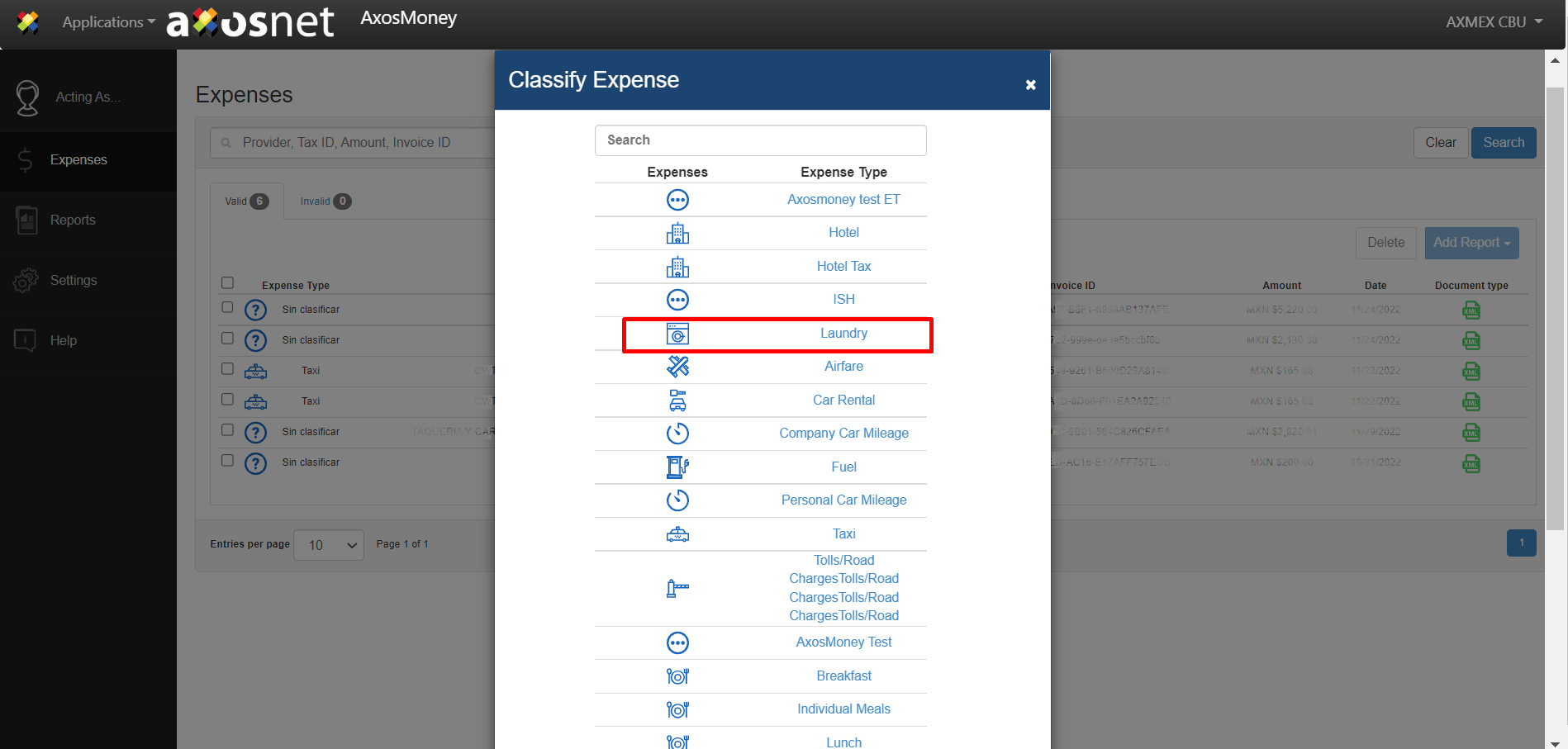

4. AxosMoney shows a catalog of types of expenses. Choose a type of expense by clicking on the expense name or use the section “Search” to find a specific type of expense. Also, if an expense has an incorrect type, you can change it by following the same steps.

Note: The list of expenses shown is for illustrative purposes only. The expenses available to you depend on your company’s expense configuration in SAP Concur.

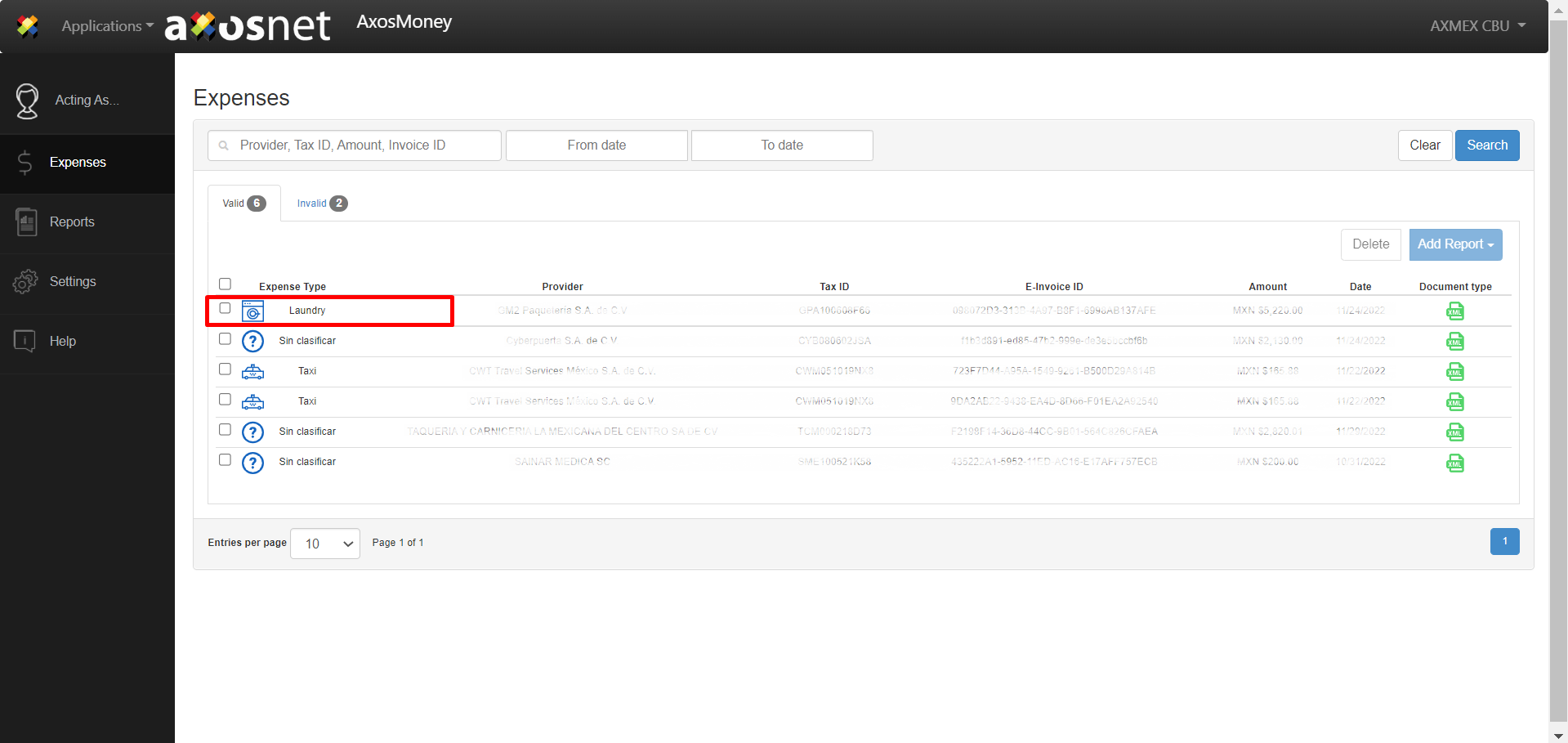

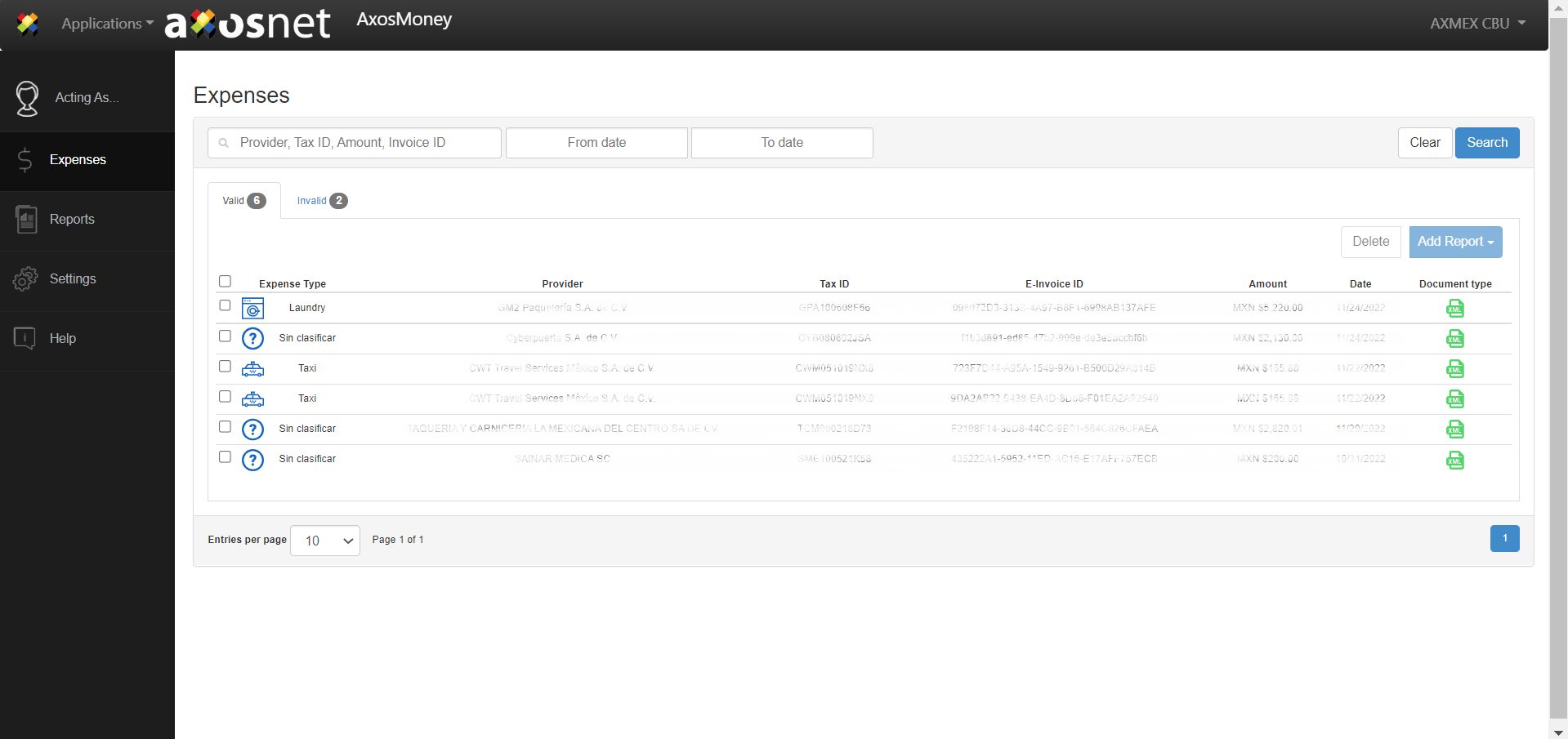

5. AxosMoney will update the type of expense.

Once you get all your expenses classified, you can either “add expenses to the existing report” or “add expenses to a new report,” as we will see in the following sections.

Expense types

It is convenient to mention that AxosMoney has a catalog of the most-used expense types to facilitate the review of your expense allocation. To link an expense type with a desired icon, contact the AxosMoney Service Desk.

Other-type icons.

Create a report while attaching expenses

This section will cover the process of adding a valid expense (one or several) and, at the same time, creating a new report.

Note: Only valid and classified expenses can be added to reports.

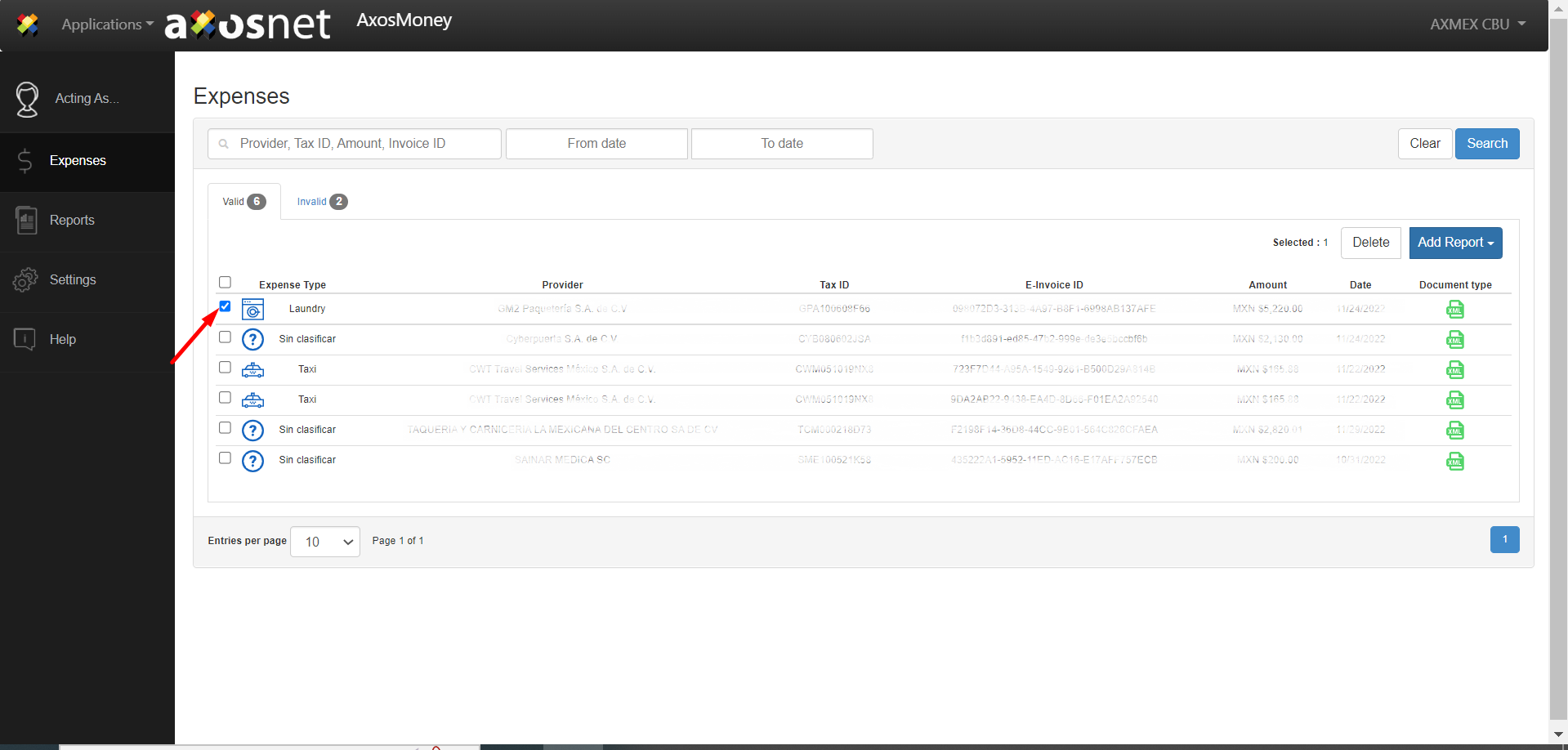

1. Go into the “Expense” menu on the left side of the homepage.

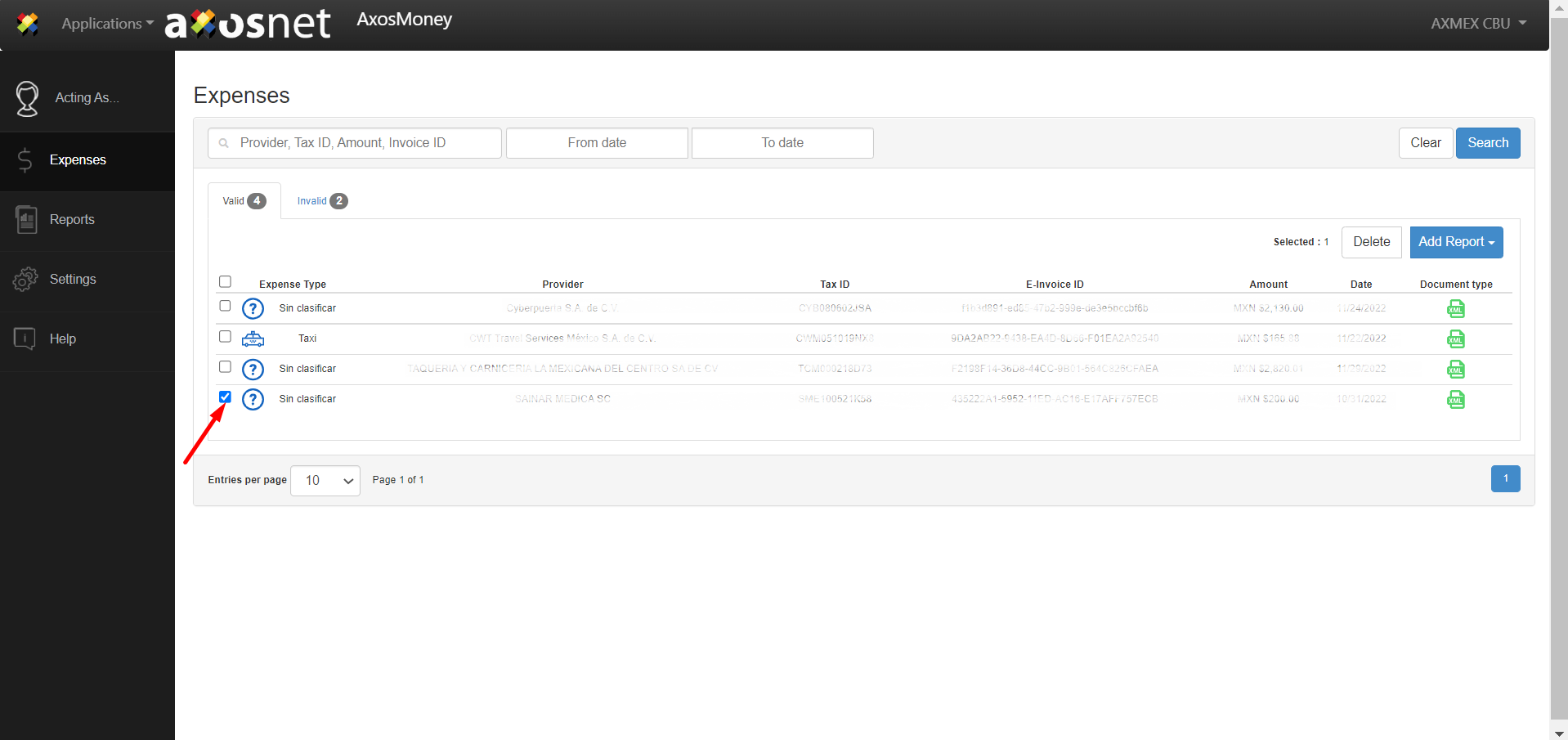

2. Select the expenses that will be added to the report.

3. Click on Add Report.

4. Select the “Create Report” option at the top of the dropdown list.

5. Type a name that identifies the report.

Use SAVE to keep the report.

Use CANCEL to dismiss the operation.

6. After naming the report, AxosMoney sends expenses to Concur.

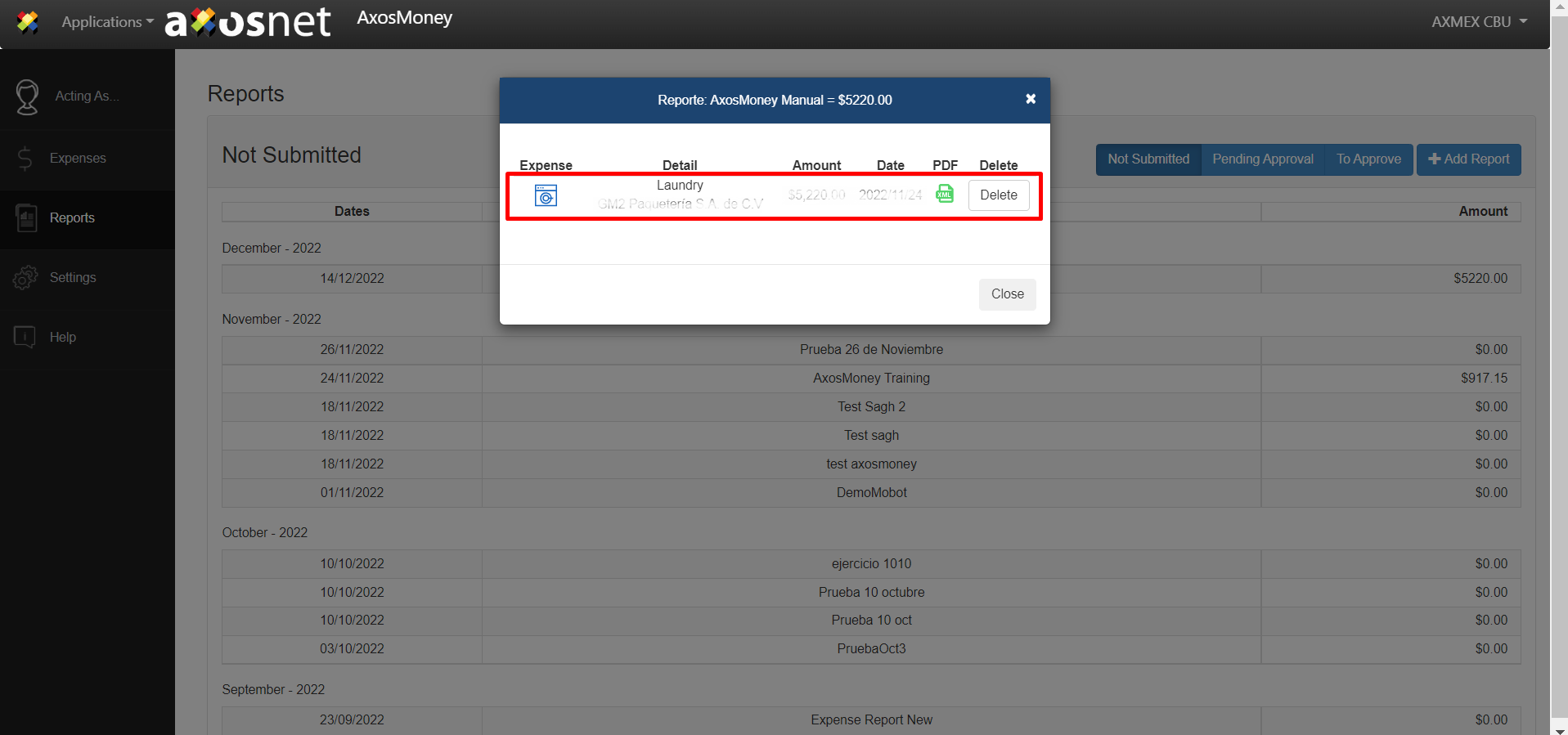

7. AxosMoney will show a window with the expenses added to the report. Click CLOSE to close the window.

8. AxosMoney updates the list of expenses removing those you added in your new report.

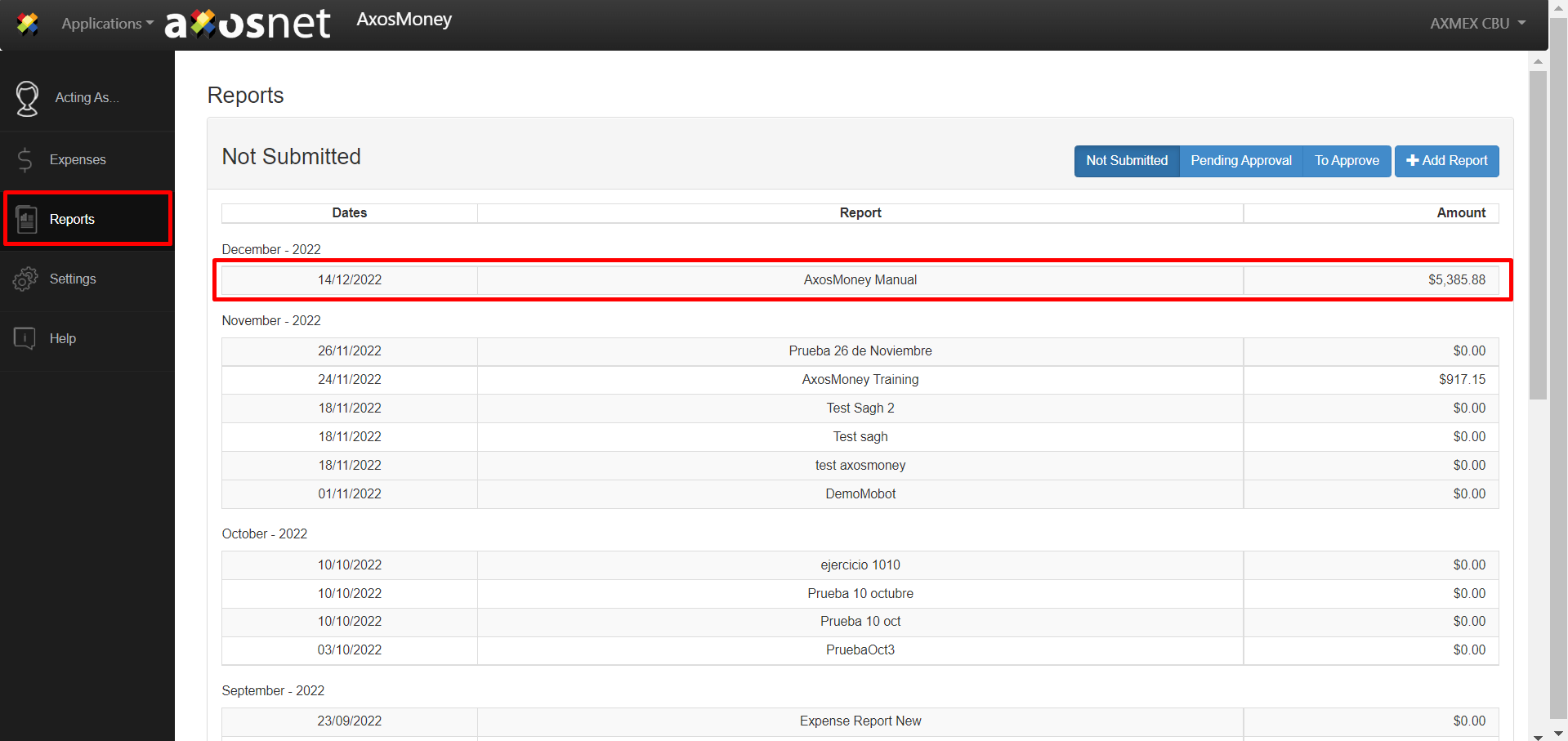

9. To check the report you just created, go to the “Reports” menu and locate the report by its name. Then, click on it to see the expenses.

10. You can confirm the expense that you added is there (or the expenses).

Attach expenses to existing reports

In AxosMoney, it is possible to add expenses to an existing report; follow the steps below.

1. Go to the “Expenses” menu and click the “Valid” tab.

2. Select the expenses that will be added to the report.

3. Click on Add Report.

4. AxosMoney will display a list of reports related to your Concur account. Choose a report.

5. AxosMoney sends expenses to Concur.

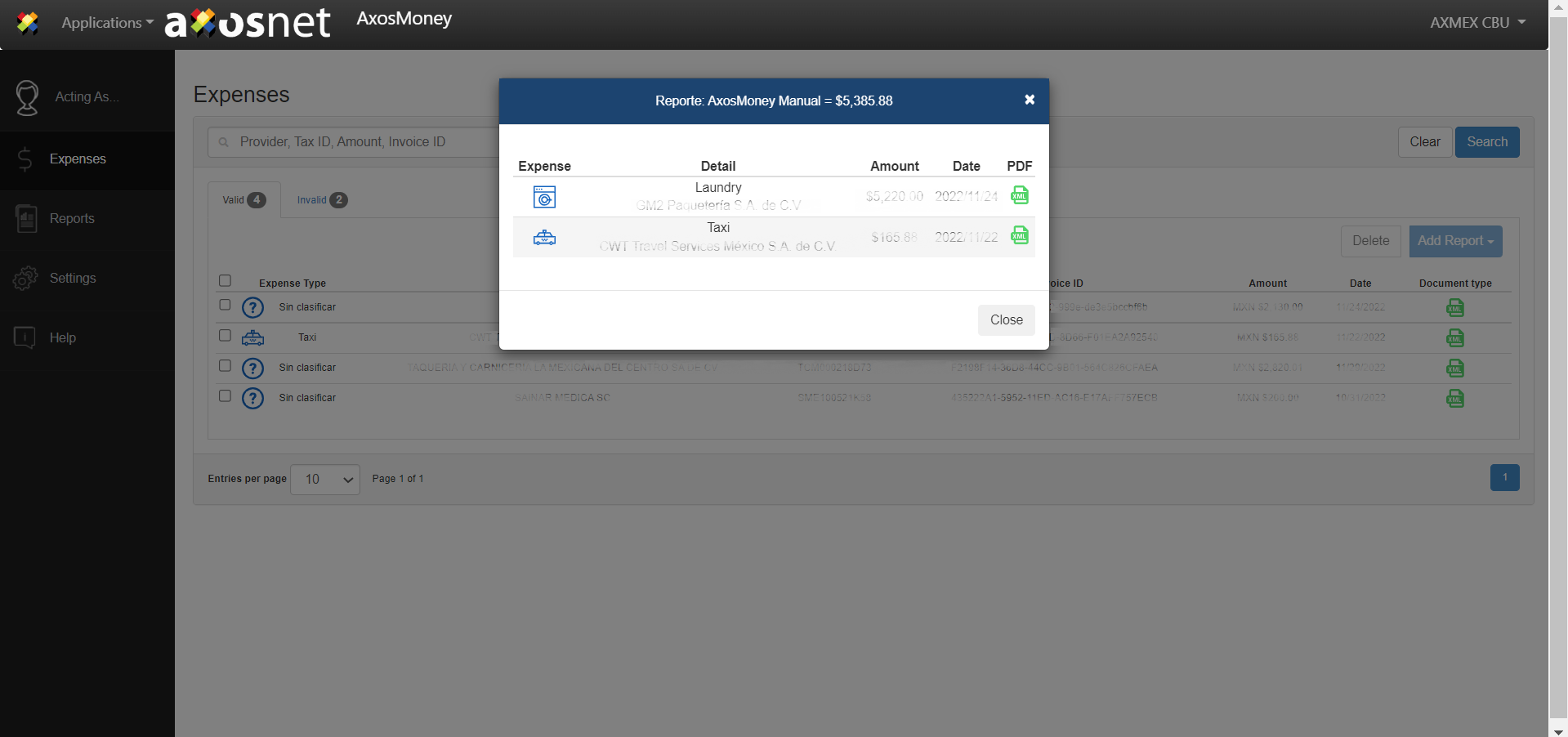

6. AxosMoney will show a window with all the expenses in the report. Click CLOSE to exit from the window.

7. The list of valid expenses will be updated.

8. To check the report you just created, go to the Reports menu and locate the report by its name. Then, click it to see the expenses.

9. A window with all the expenses inside the report will appear.

Review a valid Expense

It is possible to review the status of every parameter taking part in a validation. Parameters are related to SAT criteria or tolerances your company wants to set.

1. Go to the Expenses section.

2. select an expense and click on it.

3. A window with options will be displayed. For example, select the option “Expense Details” to see the expense details.

4. A Details window will pop up showing every validating parameter and its status. For example, an expense with correct validation will have a green checkmark, while the incorrect validations will have a red cross. Click CLOSE to leave the window.

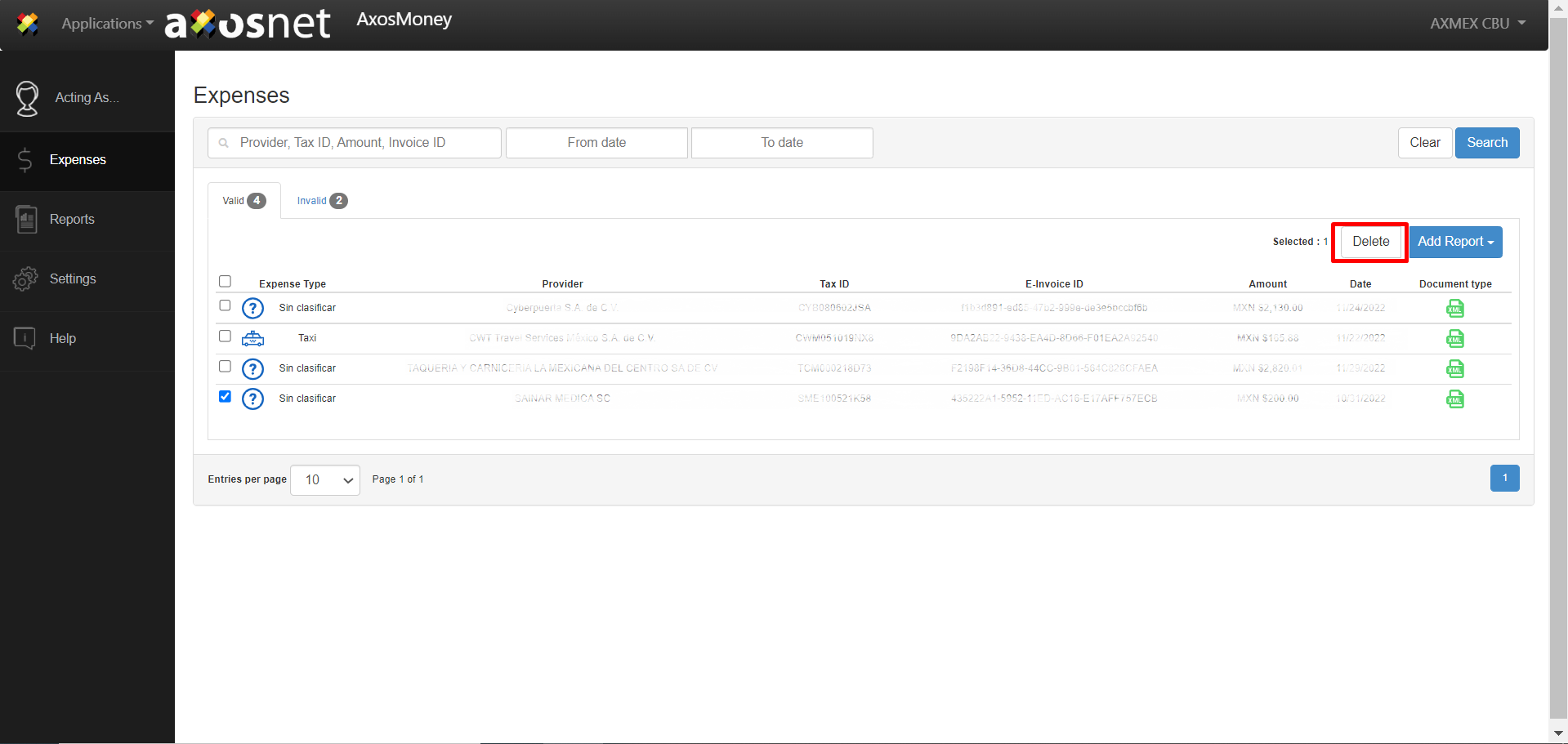

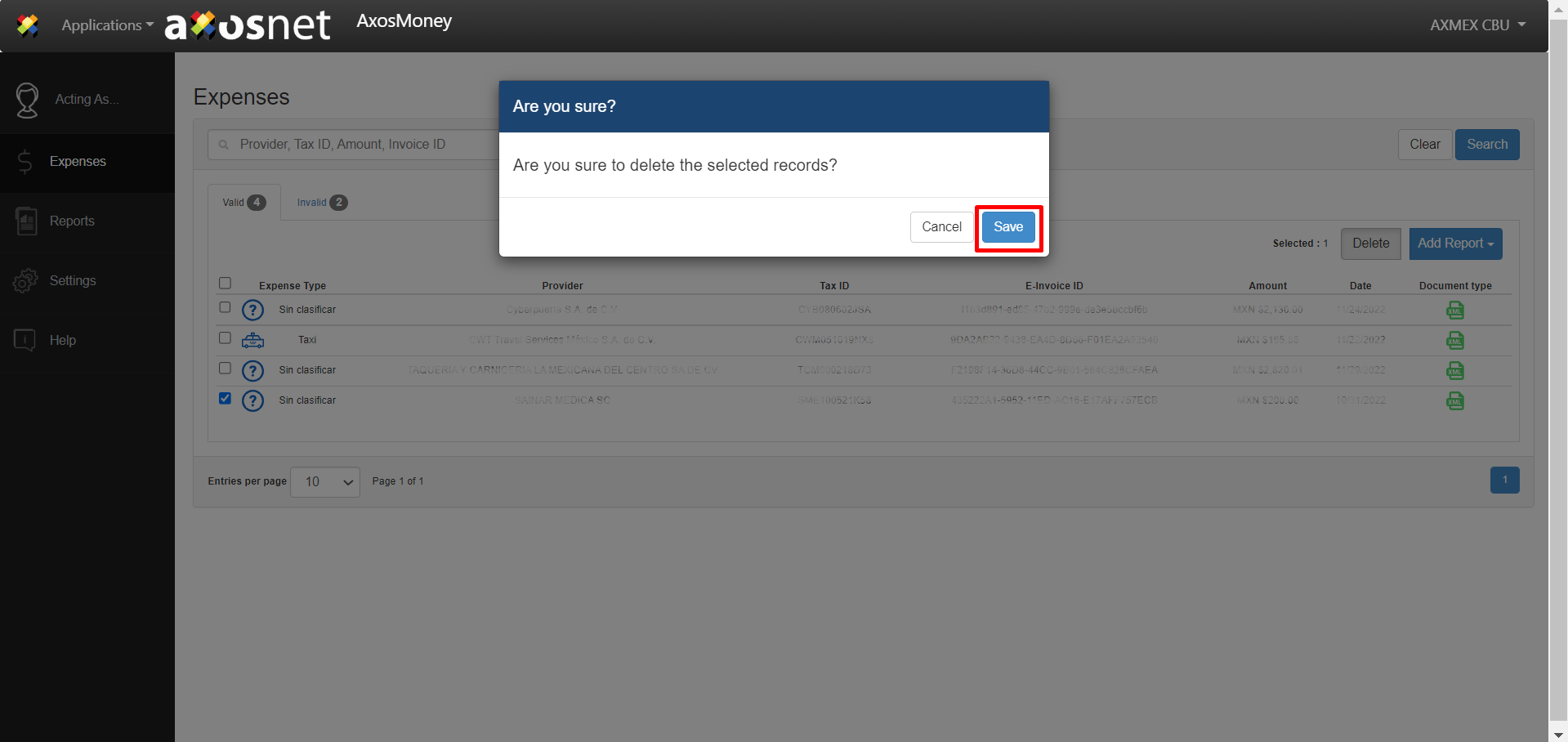

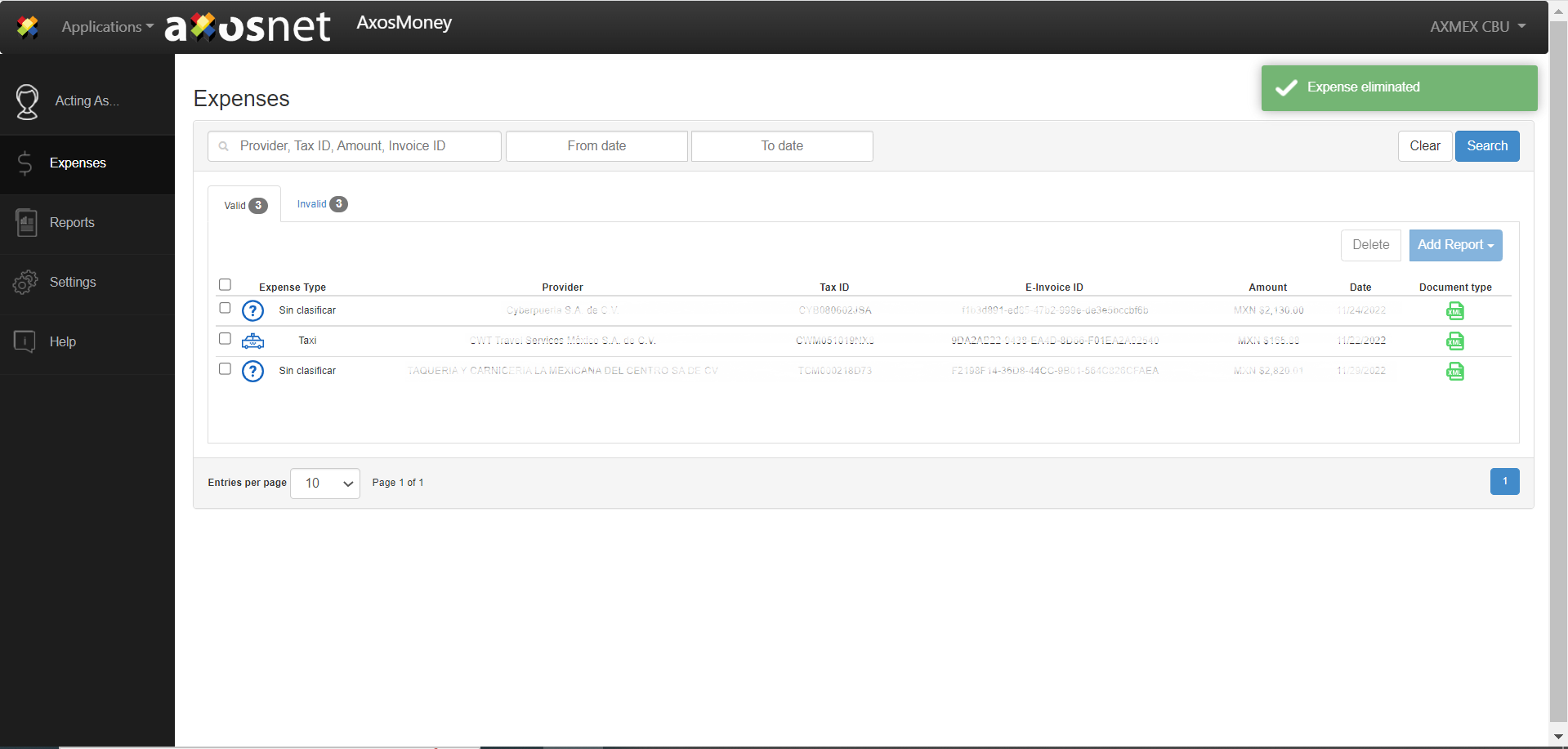

Delete Expenses

The following instructions describe the steps to eliminate a valid or invalid expense that is not added to any report.

1. Enter the option “Expenses” from the main menu.

2. Select the expenses you want to eliminate.

3. Click the button DELETE.

4. A pop-up window will ask you to confirm if you want to delete the selected expenses. Click ACCEPT to delete.

5. AxosMoney eliminates expenses, selects and updates the page.