The different validations performed by Axosnet Cloud Portal are shown below.

Validation with a purchase order

When you configure additional validations in SAP, the overall result will appear in the Axosnet Cloud Portal “Ingreso de Facturas” page under the “Comercial” column.

In the following sections, we comment on the validations with the purchase order.

1. The first validation process that will be carried out is when the purchase order is entered in the supplier portal, where: Vendor ID is validated to exist within SAP.

2. It is validated that the purchase order contains available merchandise entries

3. The VerFacEM field (Verification based on goods receipt) is active within the PO. Subsequently, the three-way match is carried out where the following validations are considered:

- Valid if it is an Income or Exit

- Validation of the currency of the invoice against the currency of the purchase order

- Validation on the supplier of the purchase order is equal to the issuer of the XML.

- Validation of the subtotal of the XML is equal to the position (s) selected according to tolerance.

The type of position is validated:

- Condition

- Service

- Material

- Generation of a RE document type

- Assign the UUID in the SGTXT field in the draft document.

- Assignment of VAT indicator in the preliminary according to the indicator in the purchase order.

- Axosnet part identifier in the BKTXT field of the draft document.

- Assignment of the Folio of the XML in the XBLNR field of the preliminary document.

Validations without a purchase order

When you configure additional validations in SAP, the overall result will appear in the Axosnet Cloud Portal “Ingreso de Facturas” page under the “Comercial” column.

We comment on the validations without a purchase order in the following sections.

It is valid in the FI module.

The first validation process that will be carried out is when it is entered through the FI module in the supplier portal where:

- Vendor ID is validated to exist within SAP.

Subsequently, to generate a preliminary document, the following is done:

- Gets the dependent currency of the company.

- Validate that the Receiving Tax ID corresponds to a company in SAP.

- The exchange rate is obtained if necessary.

- Gets the tax code with respect to the company code.

- Get payment terms.

- A document type KR is generated.

- Assignment of the Folio of the XML in the XBLNR field of the preliminary document.

- Assignment of the Invoice Id in the SGTXT field in the preliminary document.

- Axosnet part identifier in the BKTXT field of the draft document

- The generation of this preliminary only contemplates header information.

Banned Lists

While validating your invoices, Axosnet Cloud Portal can check if any of your suppliers is published in the SAT’s banned lists. This additional check differs slightly from the original validation; however, it needs to be activated by the Commercial department.

| Make sure your company has activated this feature. If required, you can confirm any time with Axosnet Customer Service. |

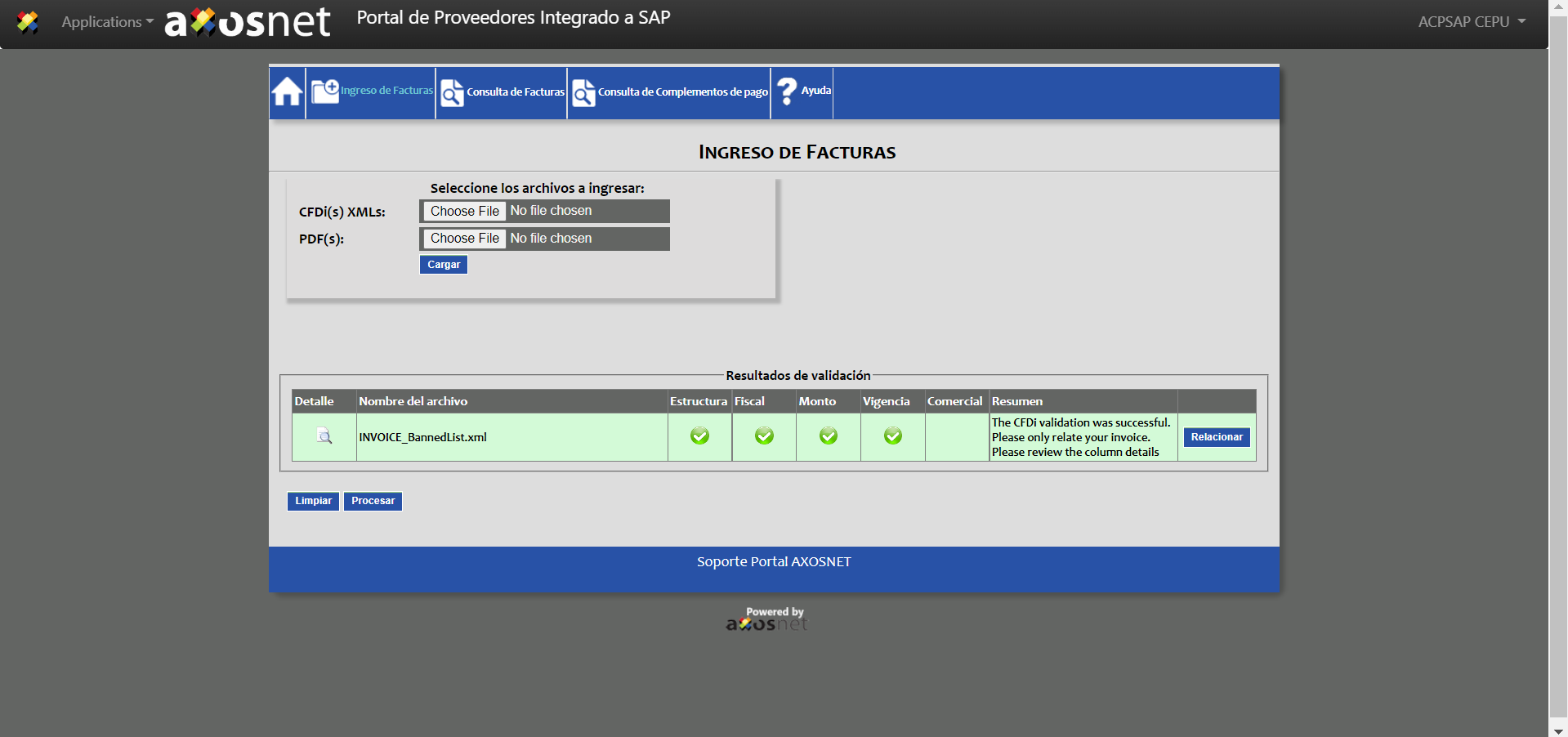

The SAT’s banned lists invoices validation process follows as described below:

1. Follow the process of submitting an invoice for validation described in the invoice upload section.

2. You will get the results of validation as usual. Note that the “Resumen” column will ask you to review the details.

3. Inspect the “details” section and observe the description marked with a blue ‘i’:

For more information about the SAT banned lists assumptions considered in the validation process, consult the “Messages” section.