To validate a single invoice, follow these next steps:

1. Sign In to the Axosnet Cloud Solutions platform https://acs.axosnet.com/.

Note: If you need further information, please refer to the ACS Manual, Log in section

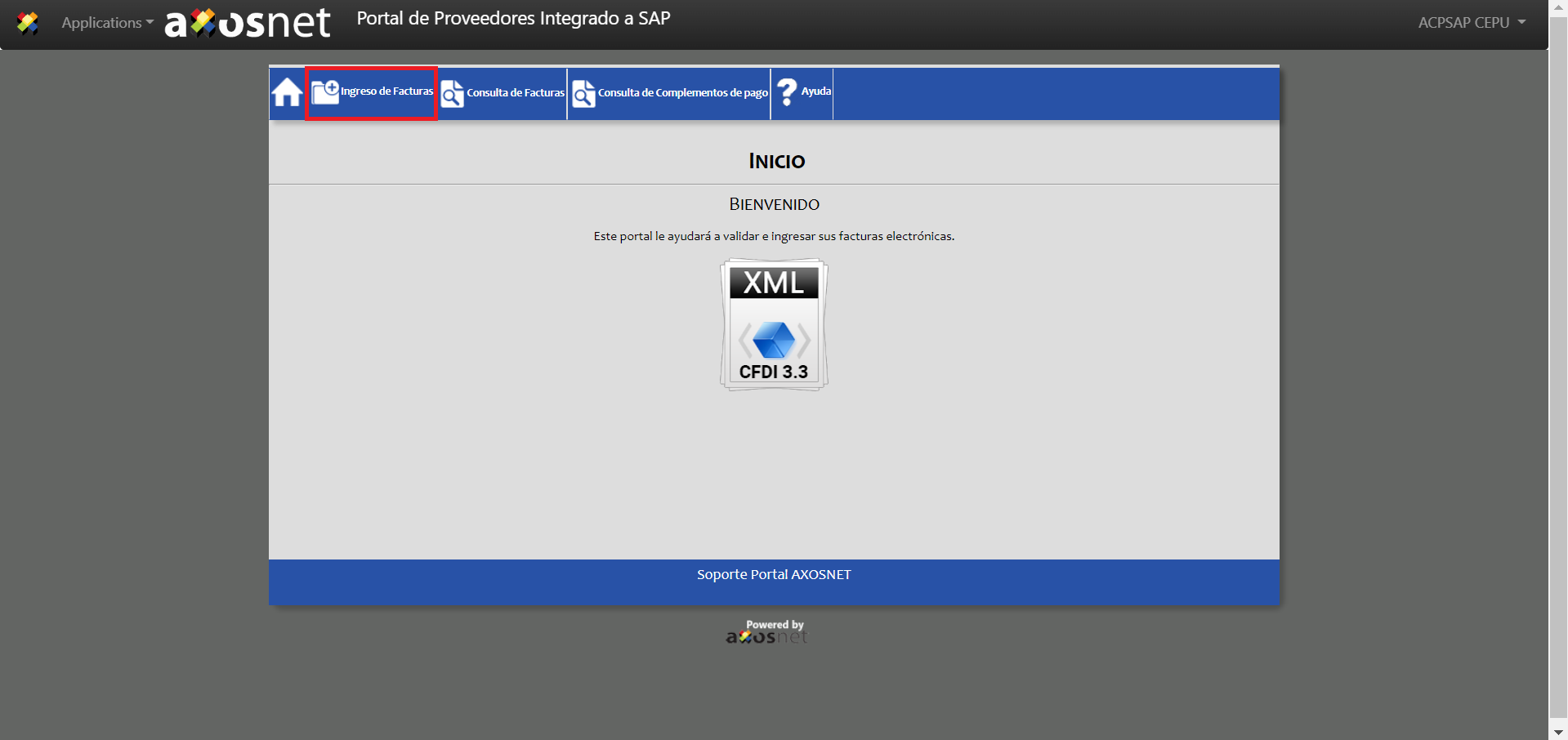

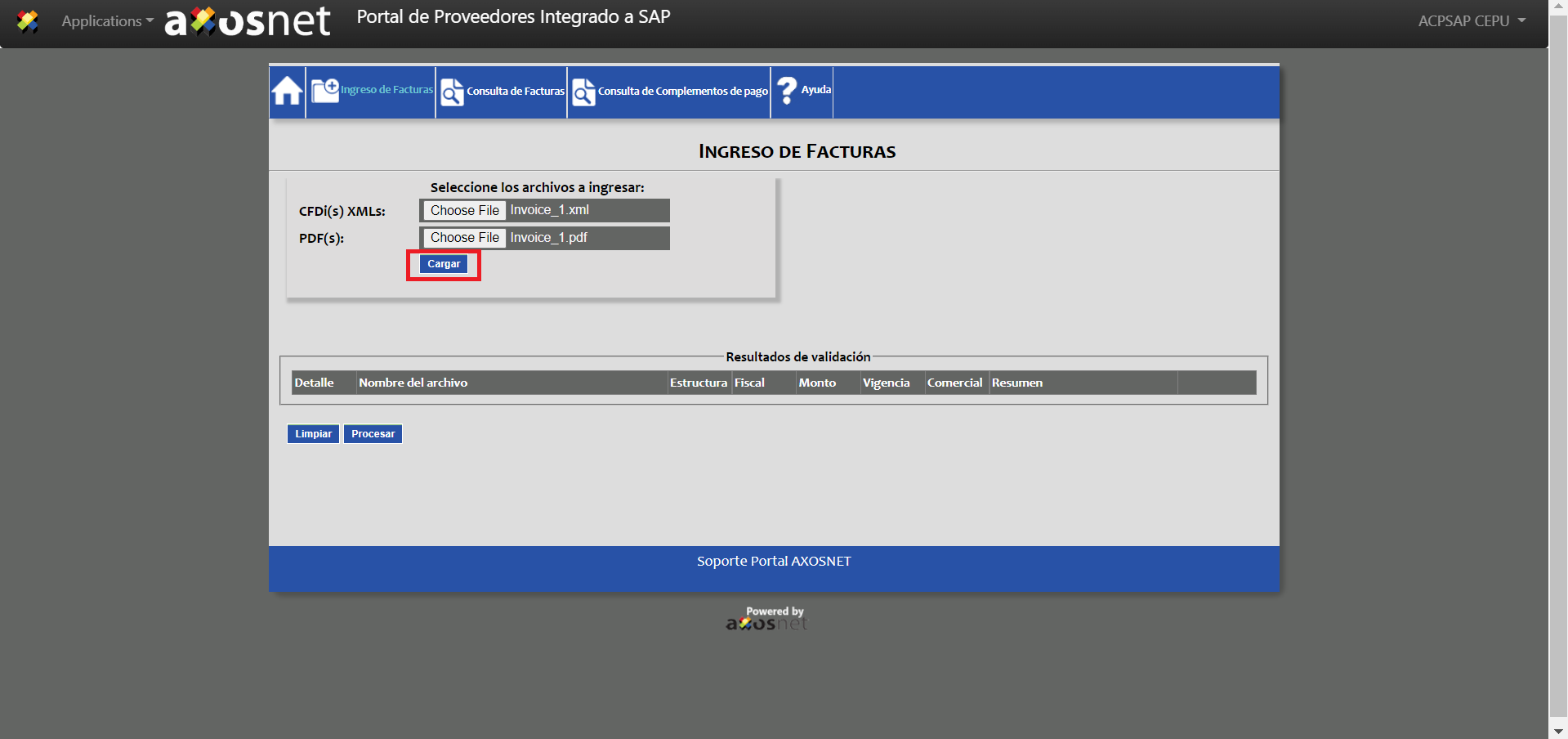

2. Once you have registered in the supplier portal, you must enter the “Ingreso de Facturas” section.

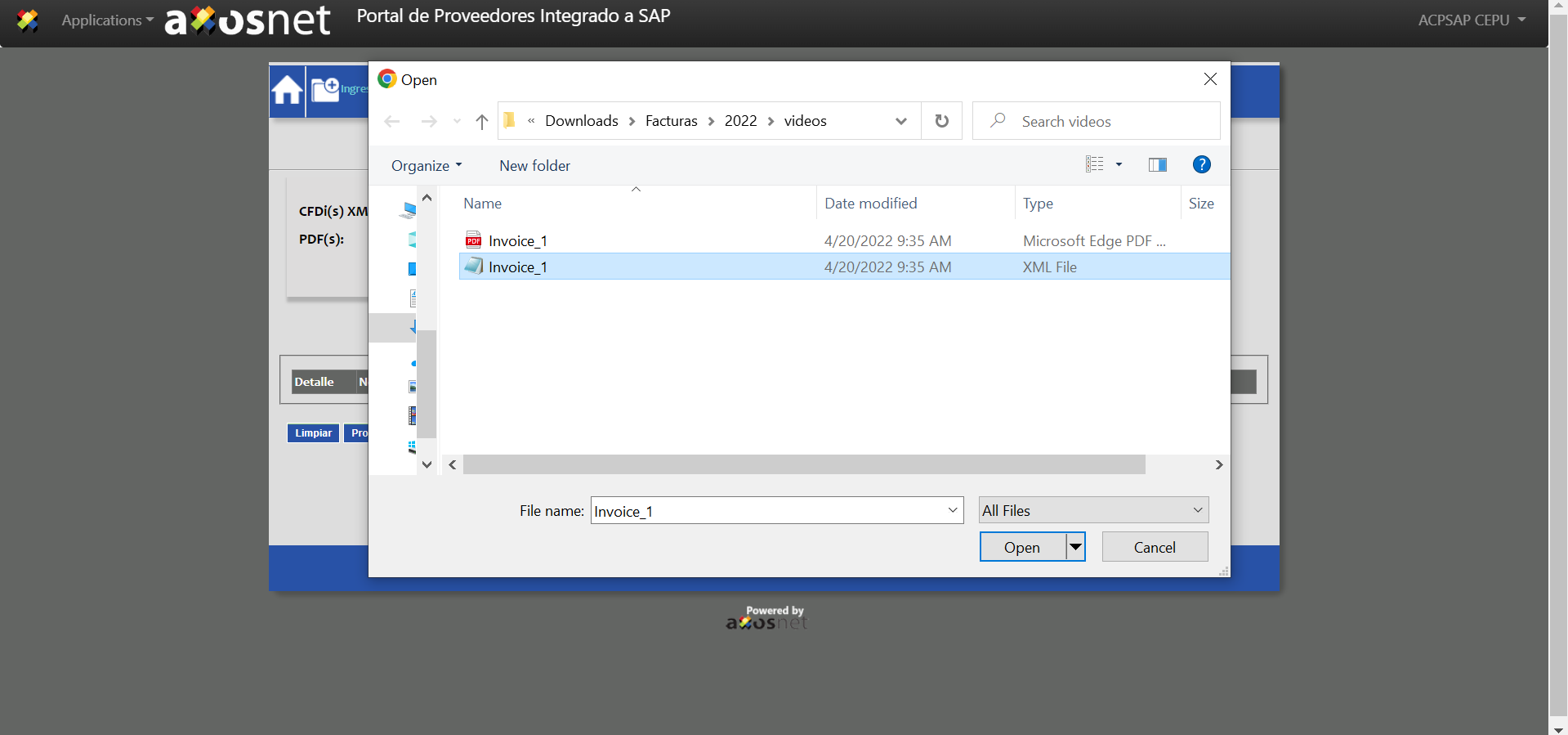

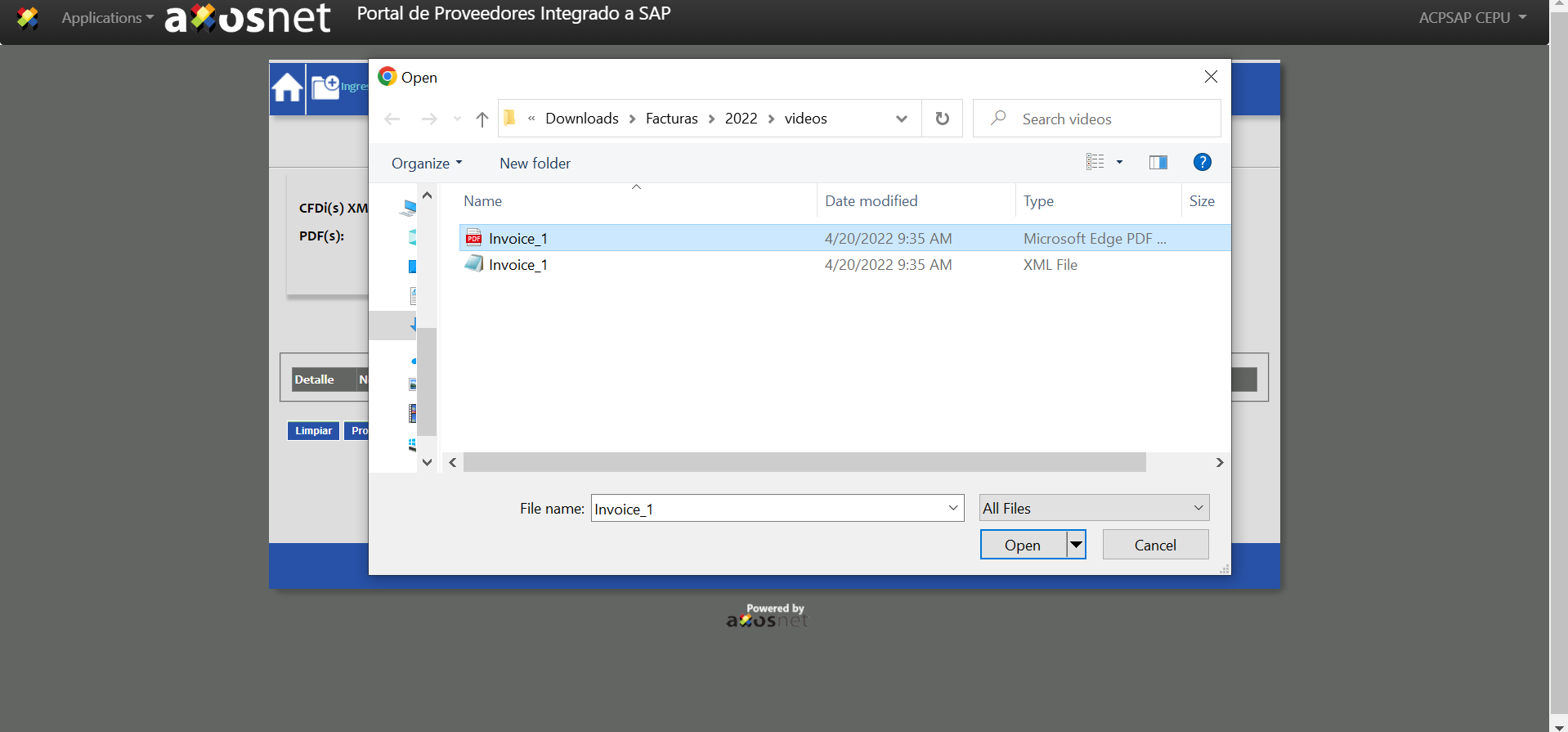

3. Click “Choose File” in the “CFDi(s) XMLs” field.

4. A file explorer window will appear, select the xml file from your invoice.

5. Click “Choose File” in the “PDF(s):” field.

6. A file explorer window will appear, select the pdf file from your invoice.

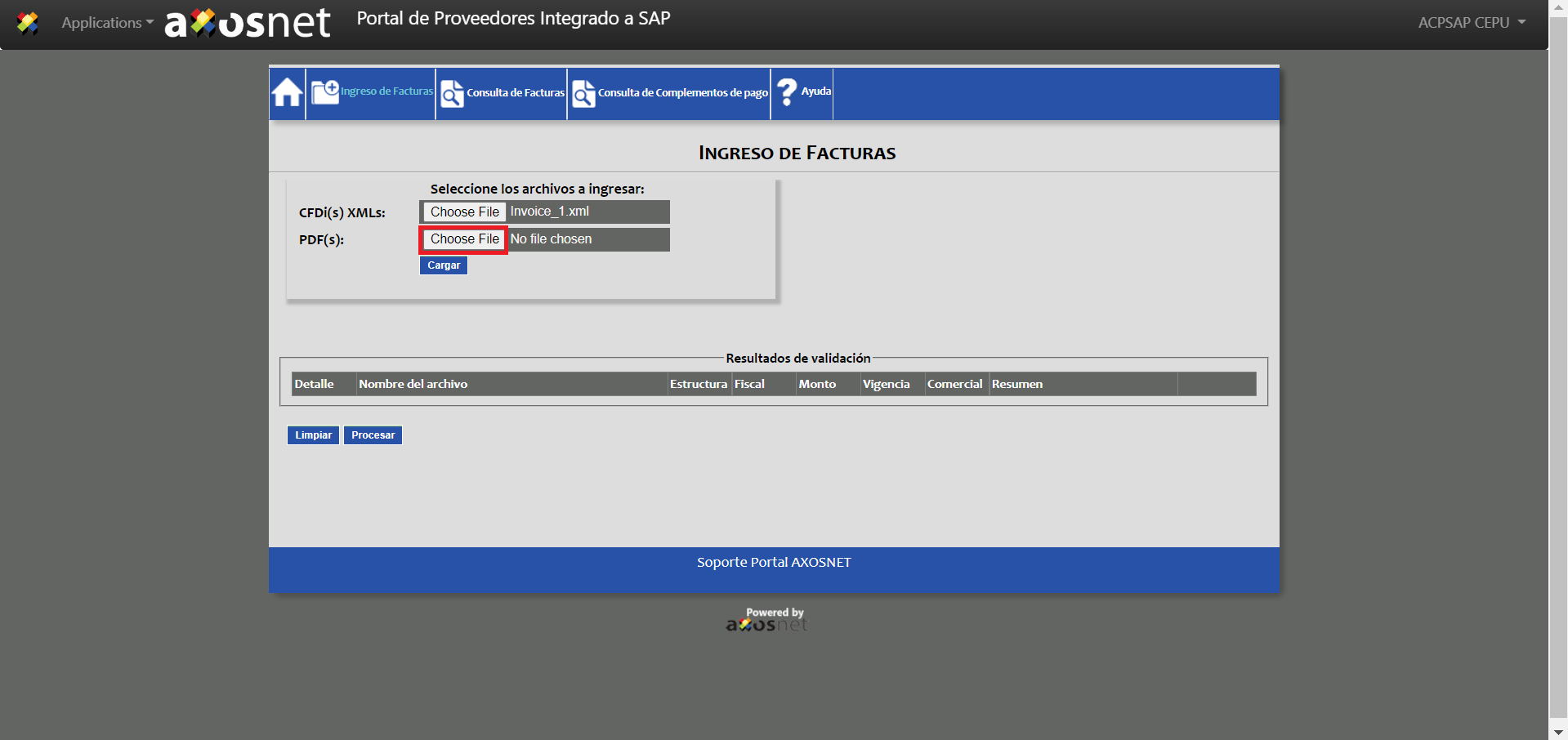

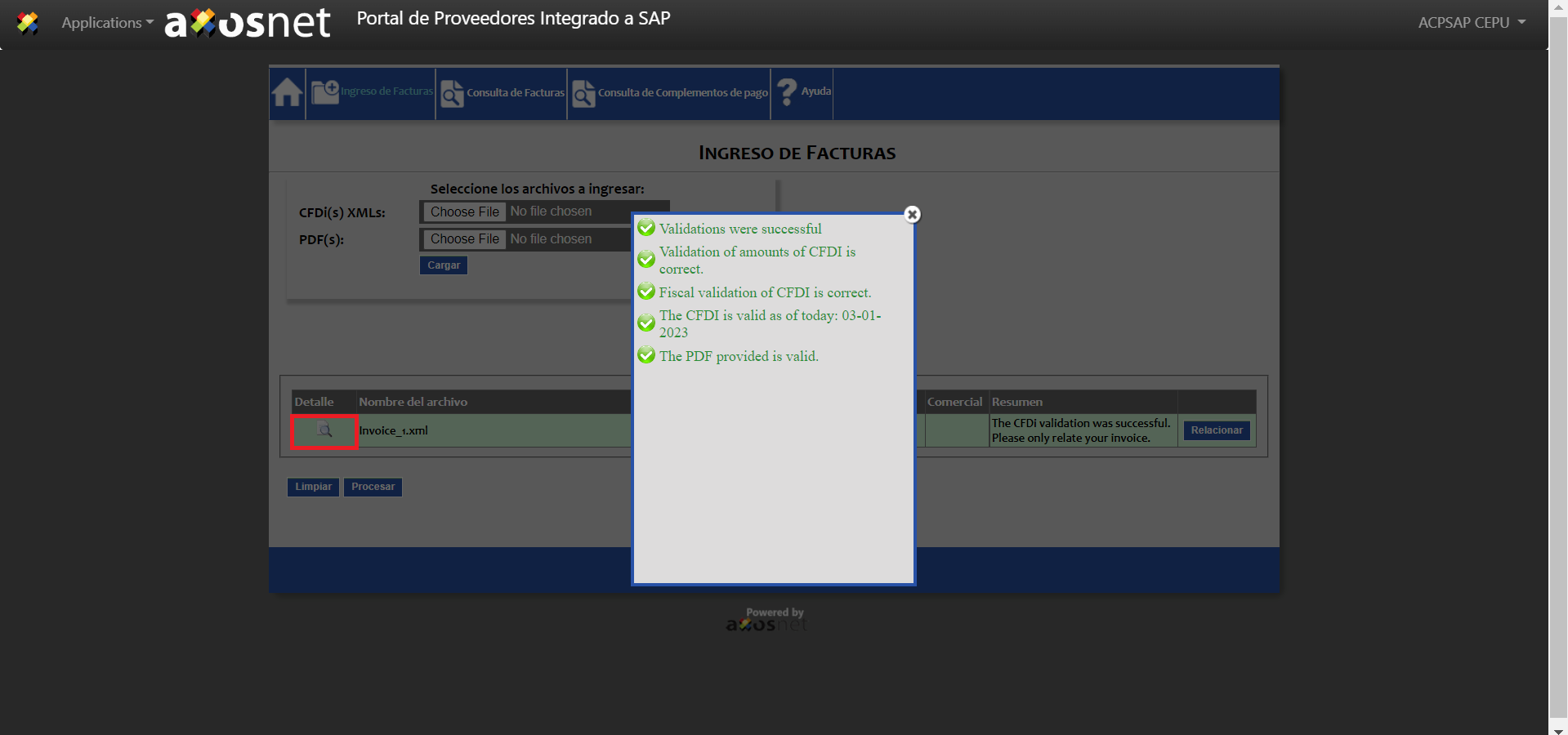

7. Click “Cargar” and wait for the system to perform the corresponding operations.

8. The system will perform the Tax validation:

Structure. – That the CFDI complies with the guidelines of annex 20 of the SAT.

Fiscal. – That the certificate and stamp of the invoice are valid.

Amounts. – That the sum of the subtotal of the items is equal to the subtotal of the invoice.

Validity. – That the invoice is valid before the SAT.

9. By clicking on the magnifying glass icon in the “Detalle” column, you can consult the details of any invoice validated.