DSD is a feature that generates CFDIs from purchase receipts digitized through the AxosMoney application.

AxosMoney offers the ability to select the appropriate flow for the receipt to be recorded as an expense. This ability is determined by the company the user is associated with and the receipt’s nationality.

If the user belongs to a Mexican company and the receipt is Mexican, the DSD process is carried out to generate the CFDI. However, if the company or receipt is foreign, the process remains as a simple receipt without a CFDI.

Below is a brief description of the DSD section manuals with their respective links so you can review them in detail.

Select Billing Company

A user can be related to more than one company and therefore each of them can belong to different nationalities. Within the app configuration, it will be allowed to select the appropriate company during the invoicing process for expense registration.

For more details please see the manual: Select Billing Company

Send a Receipt from AxosMoney

This functionality of AxosMoney allows the user to generate an invoice / CFDI from the entry of a receipt.

To get more details, please visit the manual: Send a Receipt from AxosMoney

Receipt Tracking

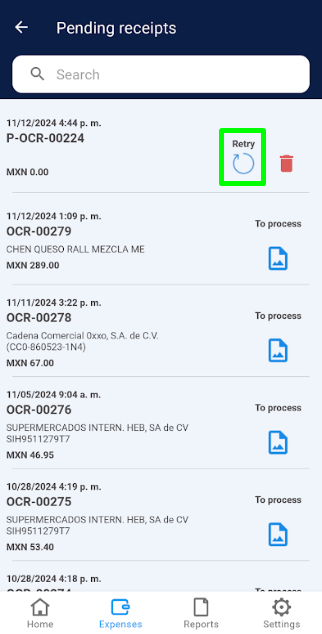

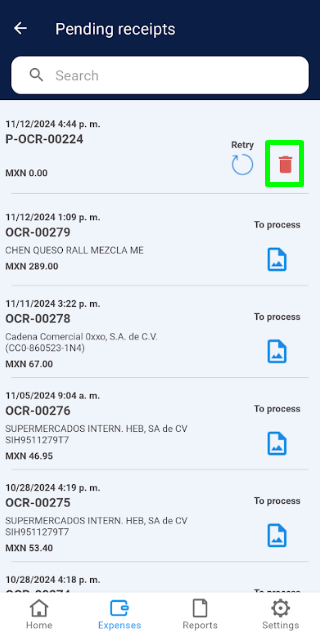

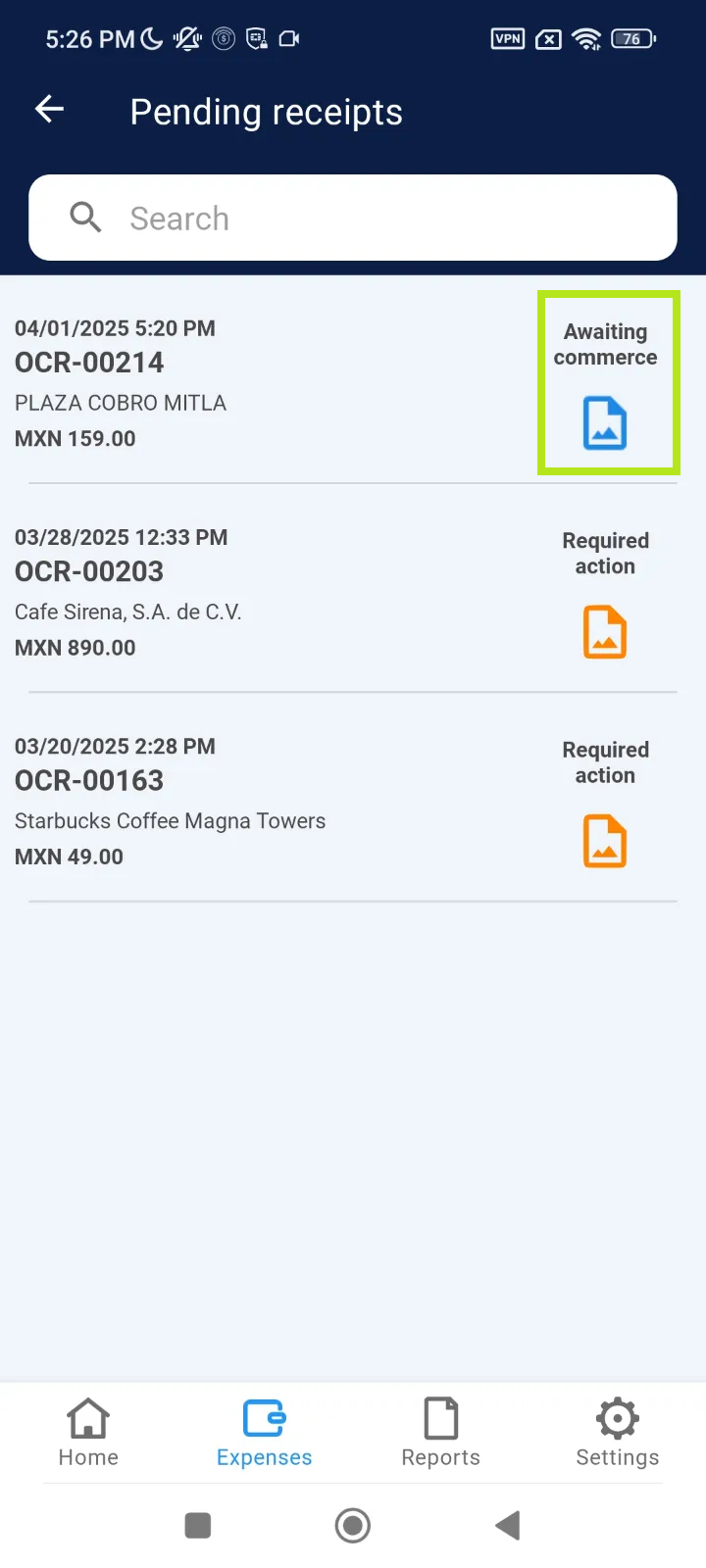

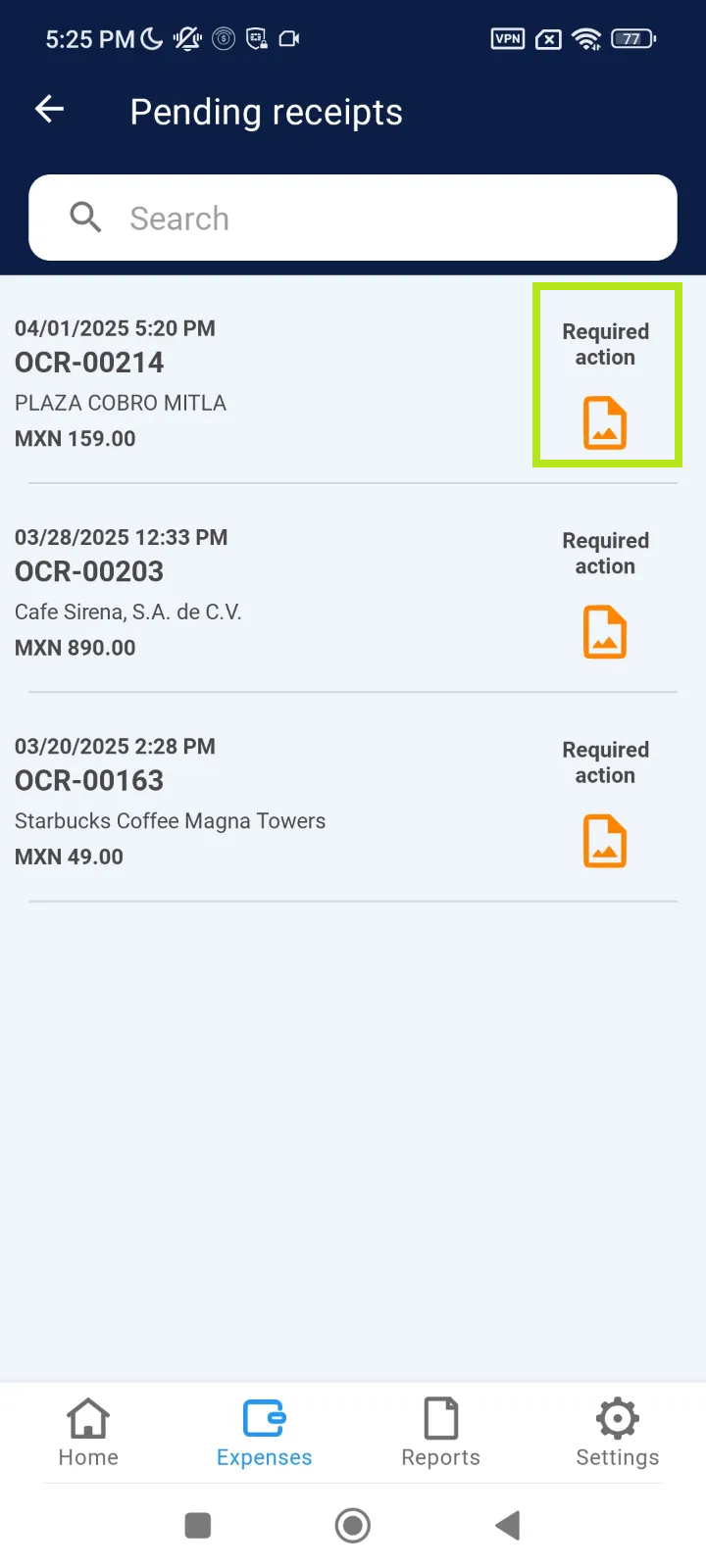

After completing the flow of Sending a Receipt from AXM in the Processing Collection section, the receipts that are still pending obtaining the CFDI will be displayed.

These manuals show us how to retry the processing of a receipt or remove a receipt from the processing queue.

To obtain more details, please visit the manuals:

Receipts Processing

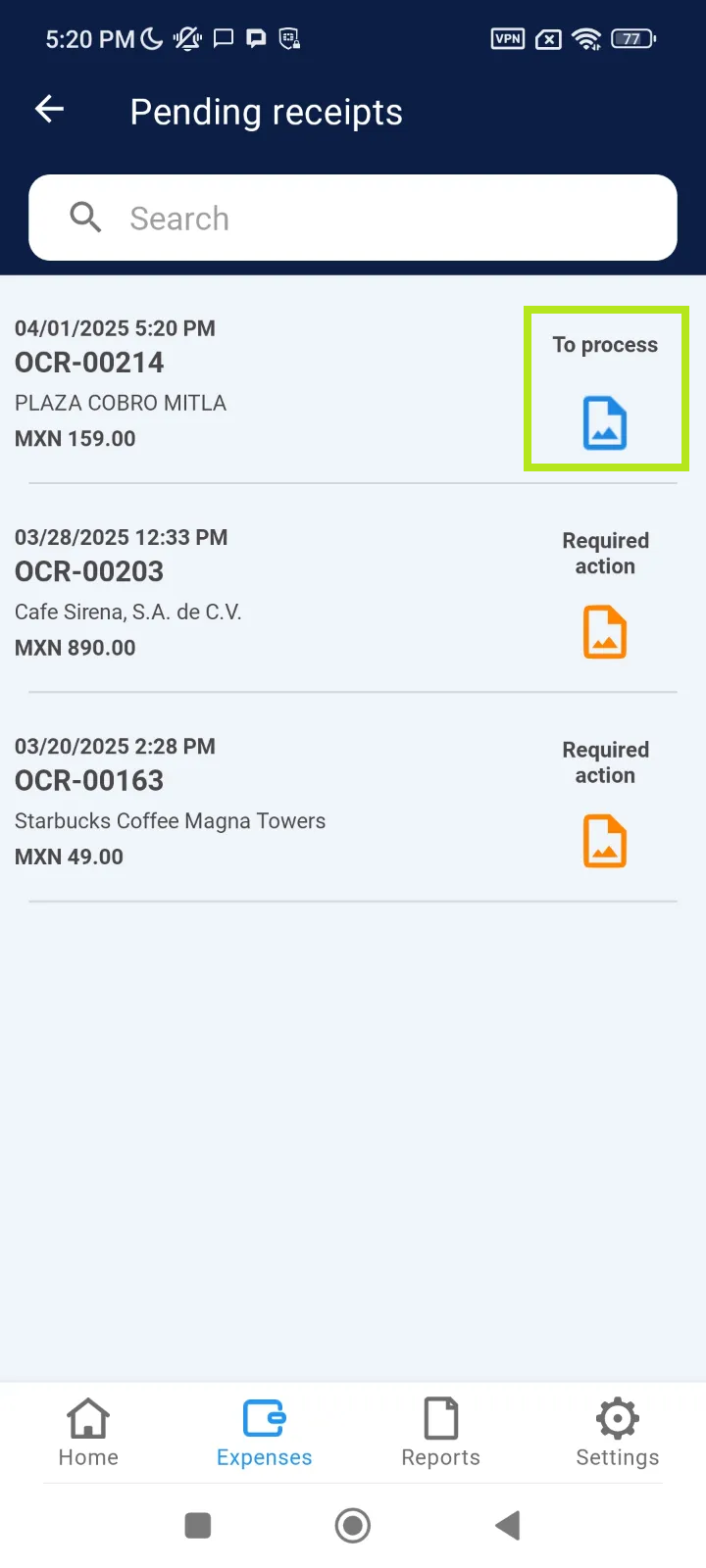

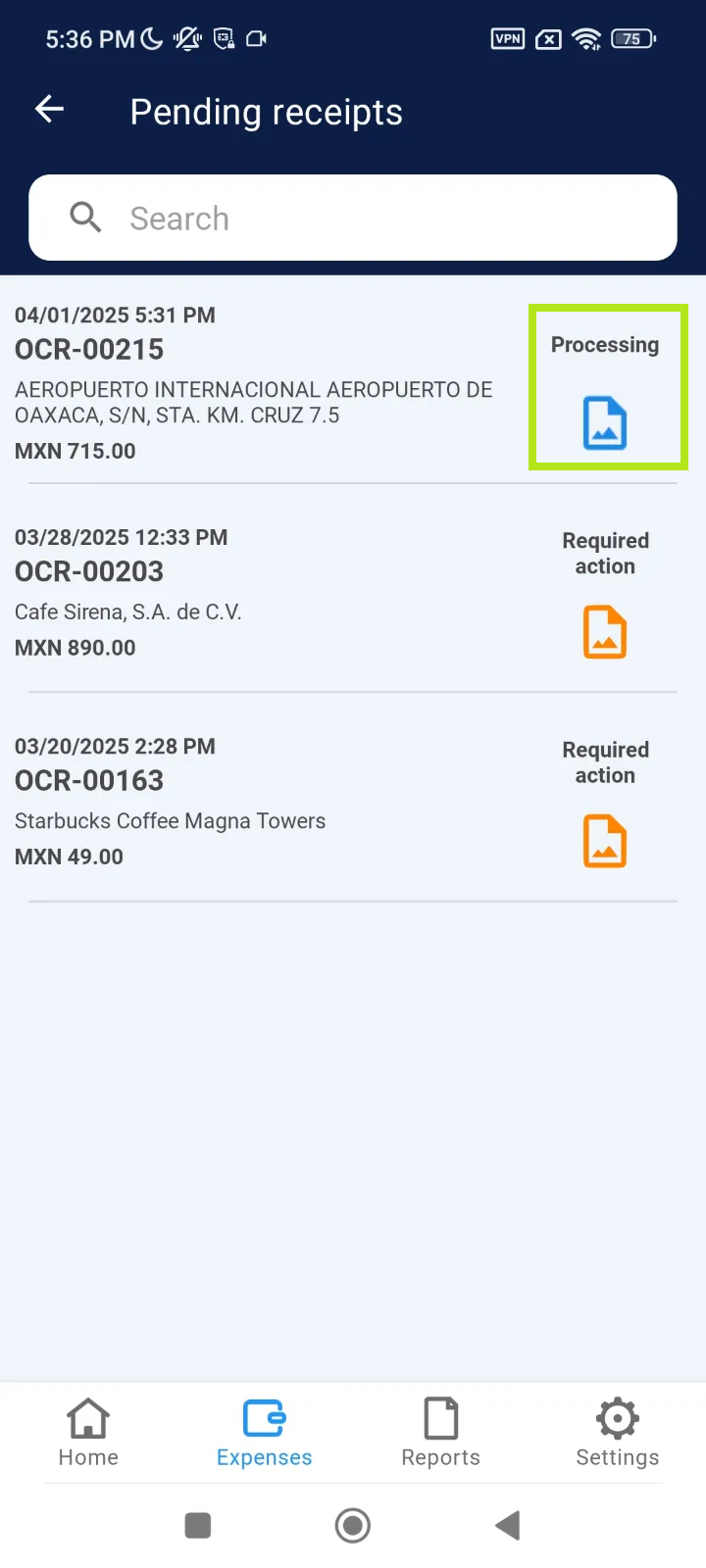

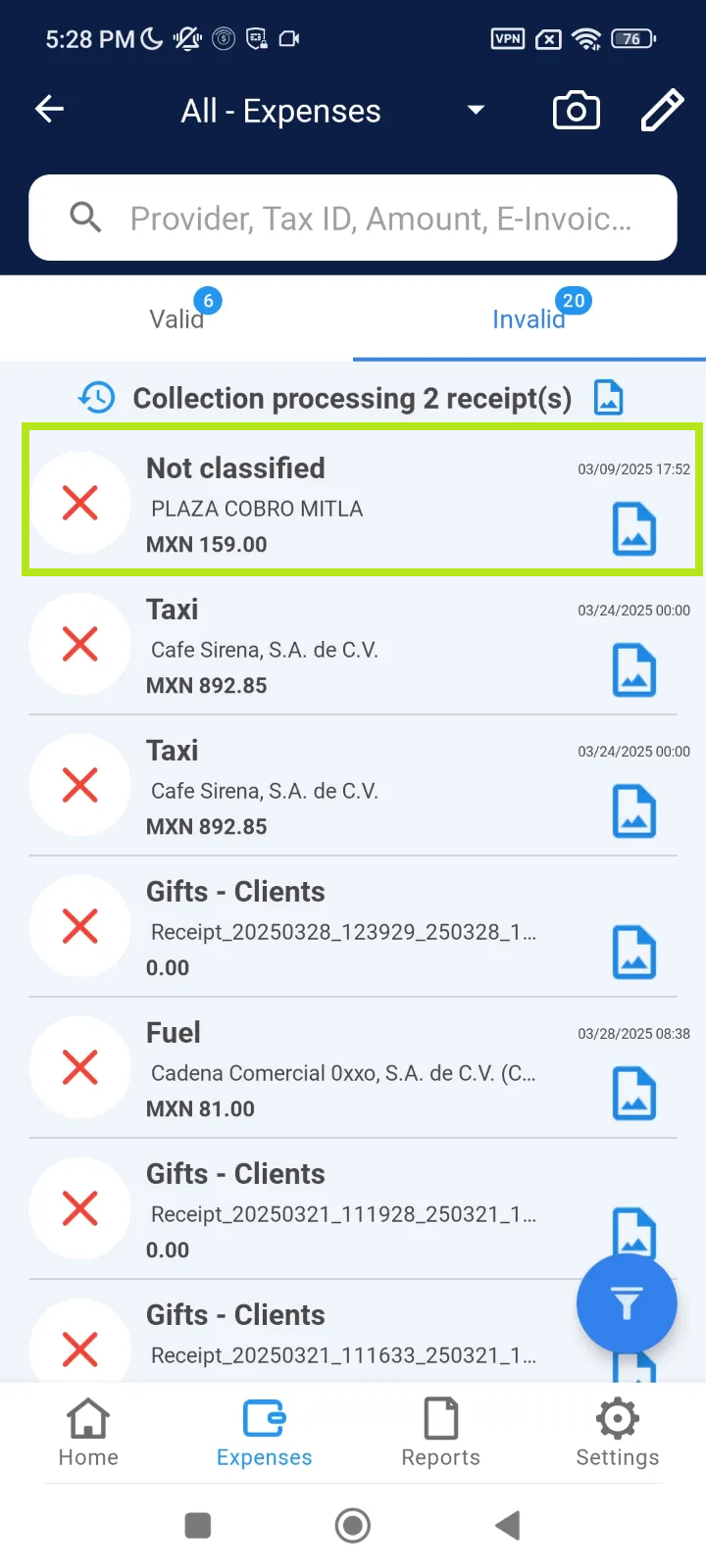

In the Processing Collection section, when a receipt is in the process of obtaining the CFDI/invoice, it can go through different statuses such as:

Receipt to Process: This status is shown when starting the process and the receipt is in the queue for the CFDI to be obtained.

Receipt Processing: This status is shown when the receipt has entered the process of obtaining the invoice / CFDI.

Receipt Awaiting Commerce: This status is shown when there is some inconvenience with the process of obtaining CFDI. For example, if the billing portal is offline or it will take more time to generate the invoice.

Receipt Pending Response: This status is shown when the user is pending to respond to an action required in the process so that the receipt can be processed for invoice issuance.

Rejected Receipt: This status is shown when the receipt has been rejected and will move to the invalid expenses section. The reasons for this may be that the billing information is incomplete or incorrect, the image is not legible, or the time to bill the receipt has expired.

Receipt Scenarios

AxosMoney offers the ability to select the appropriate flow for the receipt that will be recorded as an expense, this ability is determined by the company to which the user is associated and the nationality of the receipt.

Mexican Company with Mexican Receipts: This combination refers to all expenses with Mexican receipts recorded by a user who is related to a Mexican company. In this scenario, the receipt is processed through the DSD (Digital Signed Documents) solution in order to obtain an invoice (CFDI).

Foreign Company with Foreign Receipts: This combination allows the user to record their expenses when related to a Foreign Company and the receipts are also foreign; in this scenario, the receipt is processed as a receipt flow without generating CFDI.

Foreign Company with Mexican Receipts: With this combination, the user will be able to record their expenses when they are related to a foreign company and the receipts are Mexican, which are processed as a receipt without CFDI.

Mexican Company with Foreign Receipts: The user associated with a Mexican company can register their expenses incurred abroad; likewise, it is not required to process through CFDI.